Healthcare costs are skyrocketing, leaving many feeling the pinch. Finding affordable health insurance can feel like navigating a maze, but it doesn’t have to be. This guide provides practical strategies to help you save money on your health insurance plan, giving you peace of mind and more money in your pocket.

Understanding how to lower your health insurance premiums is crucial for your financial well-being. This article will equip you with actionable steps to reduce costs, empowering you to make informed decisions about your healthcare coverage. Stay with us until the end to discover the best solution for your specific needs.

We’ll explore various methods, comparing their pros and cons, and offering insider tips to maximize your savings. Let’s dive in!

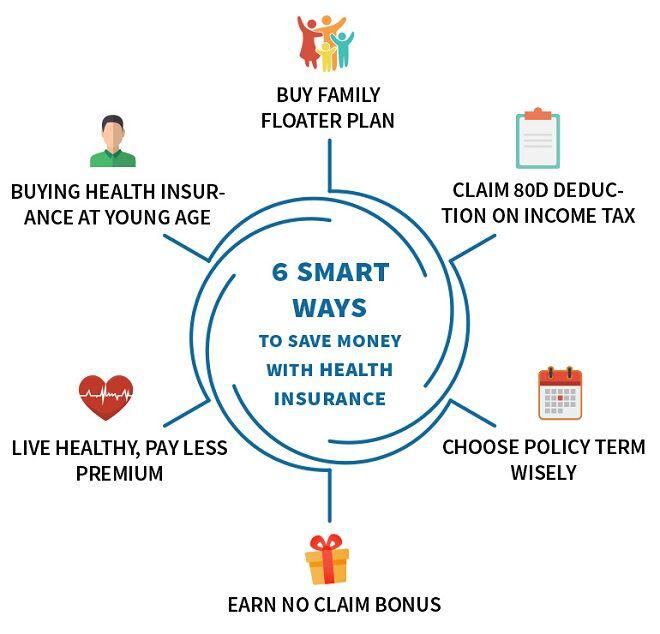

Smart Strategies to Slash Your Health Insurance Costs

There are several effective ways to lower your health insurance premiums. The best approach will depend on your individual circumstances, such as your age, health status, employment, and location. Let’s examine some of the most successful strategies.

1. Choose a High-Deductible Health Plan (HDHP) with a Health Savings Account (HSA)

A High-Deductible Health Plan (HDHP) features a higher deductible than traditional plans, meaning you pay more out-of-pocket before your insurance kicks in. However, this is often offset by significantly lower monthly premiums. This approach works best for individuals who are generally healthy and can comfortably handle higher upfront costs.

The key to maximizing savings with an HDHP is pairing it with a Health Savings Account (HSA). An HSA is a tax-advantaged savings account specifically designed for use with HDHPs. You contribute pre-tax dollars, which grow tax-free, and can withdraw funds tax-free to pay for qualified medical expenses. This makes it a powerful tool for long-term savings.

Pros: Lower monthly premiums, tax advantages of HSA contributions and withdrawals, potential for significant long-term savings.

Cons: Higher out-of-pocket costs before the deductible is met, requires disciplined savings habits for the HSA.

- Research different HDHP options available in your area.

- Compare deductibles, co-pays, and out-of-pocket maximums across different plans.

- Open an HSA and contribute the maximum allowed amount annually.

- Track your HSA balance and medical expenses carefully.

- Consider using your HSA for routine medical expenses to maximize tax benefits.

- Understand the rules regarding HSA withdrawals for non-medical expenses (penalties may apply).

Important Tips!

Make sure to thoroughly understand your HDHP’s coverage details before enrolling. Estimate your annual healthcare expenses to determine if an HDHP is the right fit for you. Consider using online HSA calculators to determine the optimal contribution amount.

- Create a budget to track your HSA contributions and medical spending.

- Automate your HSA contributions to ensure consistent savings.

- Explore HSA investment options to grow your savings over time.

- Keep all receipts related to your medical expenses for tax purposes.

- Review your HSA investment choices periodically to ensure they align with your financial goals.

2. Negotiate Your Employer’s Contribution

Many employers offer health insurance as part of their benefits package. However, the contribution amount can vary. If you’re in a position to negotiate, consider discussing your employer’s contribution towards your health insurance premiums. This is particularly effective if you have specialized skills or are a high-performing employee. It might be worth exploring the possibility of a higher contribution from your employer to offset some of the costs.

Pros: Direct reduction in monthly premiums, simple and relatively straightforward approach.

Cons: May not be successful in all situations, requires comfortable communication with your employer.

3. Take Advantage of Employee Discounts

Several employers offer discounted health insurance plans or other wellness programs for employees. Check with your HR department or benefits administrator to see if such programs are available to you. Even a small discount can add up over time.

Pros: Easy to implement, can lead to substantial savings.

Cons: Availability varies by employer, may require additional paperwork.

4. Shop Around and Compare Plans Annually

The health insurance market is dynamic. Prices and plans change regularly. Don’t be afraid to shop around and compare plans annually during the open enrollment period. Use online comparison tools and consult with an insurance broker to find the best deal for your needs.

Pros: Ensures you’re getting the best possible price, allows you to explore different plans and features.

Cons: Can be time-consuming, requires understanding of different plan types.

5. Consider a Catastrophic Plan (if eligible)

Catastrophic health plans have very high deductibles but are much cheaper than other plans. They are only available to people under 30 or those who qualify for a hardship exemption. They work best for healthy individuals who only need coverage for unexpected major medical emergencies. This is not for everyone and requires careful consideration of your risk tolerance.

Pros: Very low monthly premiums.

Cons: Very high out-of-pocket expenses for even minor medical issues, not suitable for everyone.

Frequently Asked Questions

What is the best way to save money on health insurance?

There’s no single “best” way, as the optimal approach depends on individual circumstances. However, combining a high-deductible plan with an HSA, negotiating employer contributions, and regularly shopping around are excellent strategies.

How often should I review my health insurance options?

At a minimum, annually during open enrollment. However, if your health status or family situation changes significantly, you should review your options sooner.

What is a Health Savings Account (HSA)?

An HSA is a tax-advantaged savings account designed for use with high-deductible health plans. Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free.

Can I change my health insurance plan during the year?

Typically, you can only change your health insurance plan during open enrollment unless you experience a qualifying life event (such as marriage, birth, or job loss).

What resources are available to help me find affordable health insurance?

The HealthCare.gov website is a great starting point for finding plans and comparing costs. You can also consult with an independent insurance broker for personalized advice.

Conclusion

Saving money on your health insurance doesn’t have to be a daunting task. By strategically choosing a plan, leveraging employer benefits, and actively managing your healthcare spending, you can significantly reduce your healthcare costs. Remember to consider your individual needs and risk tolerance when selecting a plan.

Try one or a combination of the methods discussed in this article. Each approach has its advantages, and the best choice depends on your personal circumstances. Don’t hesitate to explore the options and find the one that fits your budget and lifestyle best.

Take control of your healthcare costs today and begin your journey toward a healthier and more financially secure future!